Deciphering the Motley Fool’s Investing Philosophy: A Roadmap to Financial Triumph

The Motley Fool Investing Philosophy stands as a beacon of wisdom and success in the vast landscape of investment strategies and philosophies. Founded on the principles of long-term thinking, prudent analysis, and a dash of contrarianism, this philosophy has garnered a loyal following of investors seeking short-term gains and sustainable financial prosperity.

Long-Term Perspective: The Power of Patience

=> Click here for more information: The Power of Motley Fool Investing

At the core of the Motley Fool Investing Philosophy is a profound emphasis on a long-term perspective. Instead of chasing fleeting trends and momentary market movements, the philosophy encourages investors to focus on the fundamentals of companies and their potential for sustained growth over time. This patient approach aligns with the age-old wisdom that true wealth is built gradually and steadily.

Fundamentals Over Fluff

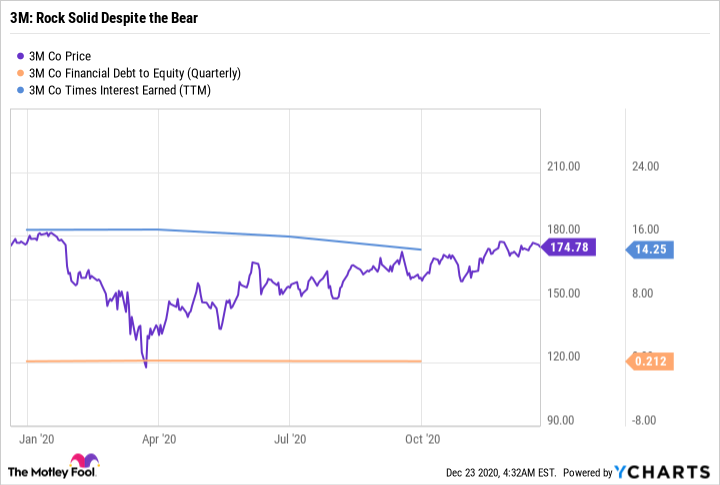

The Motley Fool’s investing philosophy places a premium on understanding the fundamental aspects of the companies you invest in. This means delving deep into financial statements, analyzing business models, and evaluating management quality. By focusing on the fundamentals, investors can make informed decisions based on a company’s intrinsic value rather than getting swayed by temporary market noise.

Contrarian Thinking: Going Against the Herd

=> Click here – for more information on Motley Fool Investing

In a world where market sentiment often dictates actions, the Motley Fool Investing Philosophy advocates for a healthy dose of contrarian thinking. This means having the courage to go against the herd mentality and make decisions that might seem unconventional at the time. Contrarianism enables investors to identify opportunities that others might overlook and capitalize on undervalued stocks that have the potential to yield substantial returns.

Investing, Not Speculating

A key differentiator of the Motley Fool’s approach is its focus on investing, not speculating. Speculation involves placing bets on short-term price movements, often driven by emotion and guesswork. Investing, on the other hand, involves thorough research, understanding the underlying business, and holding for the long term. This philosophy aligns with the idea that investing is a disciplined process rather than a gamble.

Education and Empowerment

Central to the Motley Fool’s ethos is its belief in educating and empowering investors. The philosophy isn’t just about stock recommendations; it’s about equipping individuals with the knowledge and tools needed to make their own informed decisions. Through insightful analysis, educational content, and community engagement, the Motley Fool fosters a culture of learning and growth among its followers.

Embracing Risk with Prudence

=> Click here – for Motley Fool Investing

While investing inevitably carries risks, the Motley Fool’s Investing Philosophy encourages investors to embrace risk with prudence. Diversification, understanding one’s risk tolerance, and maintaining a long-term perspective all play a role in managing risk effectively. The philosophy promotes the idea that calculated risks can lead to substantial rewards when approached with careful consideration.

In a world where the financial markets can often be overwhelming and unpredictable, the Motley Fool Investing Philosophy provides a guiding light. It champions a disciplined approach to investing, underpinned by a commitment to understanding the companies you invest in, embracing contrarian thinking, and nurturing a long-term perspective. By adopting this philosophy, investors embark on a journey that not only yields financial rewards but also cultivates a deeper understanding of the intricate world of finance